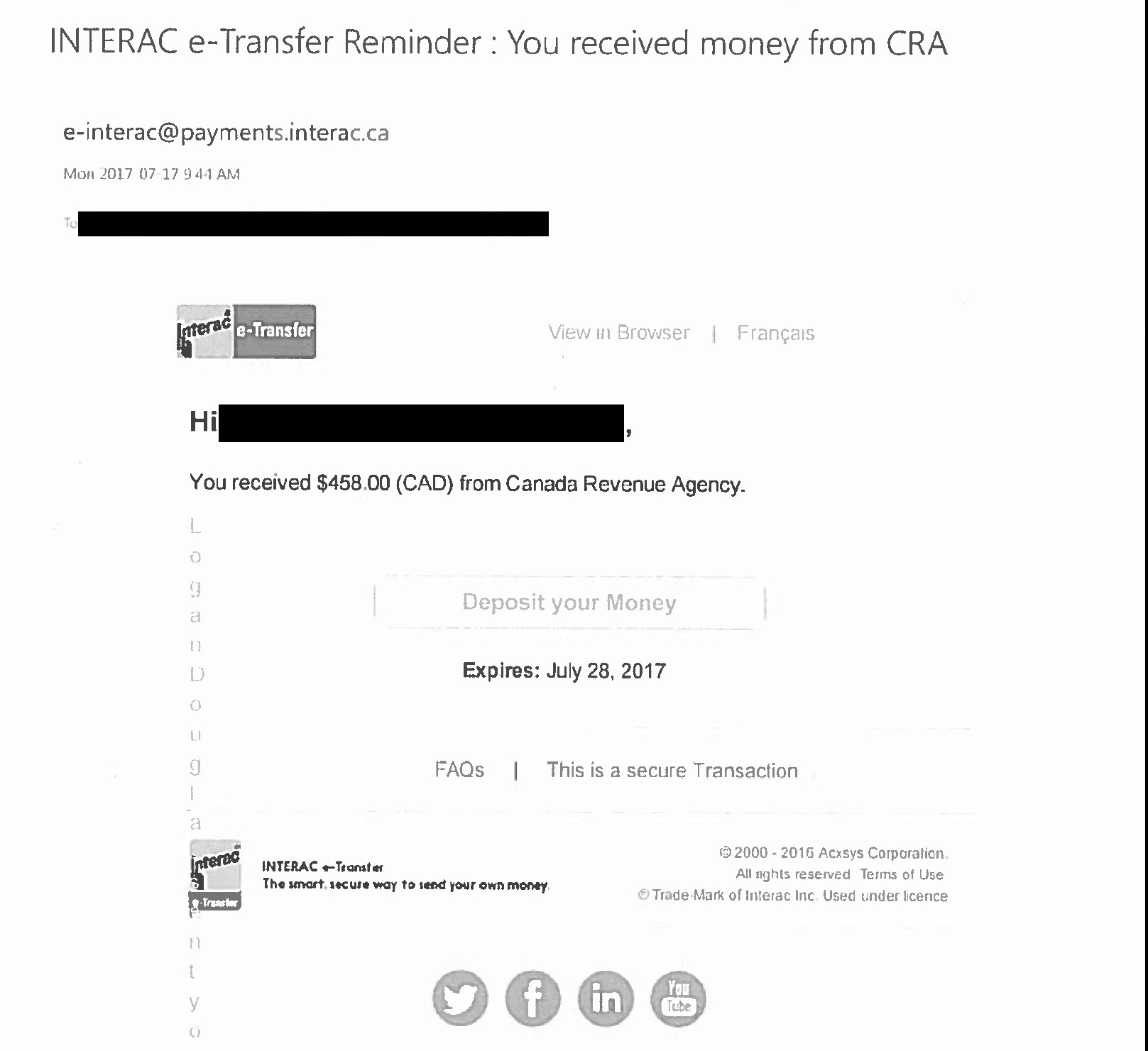

- Use direct deposit to avoid postal delays and access your funds as soon as they are deposited. Canada Revenue Agency (CRA) Payments: TD can help you enroll easily for direct deposit with the CRA. Simply provide your consent and we work with the CRA to handle the rest.

- General information on CRA Direct Deposit With direct deposit, you receive your tax refunds and benefit payments faster and securely, directly in your account at a Canadian financial institution, including G&F Financial Group. For more information and ways to enrol for.

- Direct deposit - Canada Revenue Agency; Frequently asked questions about direct deposit. You can get more information about direct deposit by going to Questions on direct deposit (Public Works and Government Services website). For direct deposit information specific to the Canada Revenue Agency, see the questions and answers below.

To Set Up CRA Direct Deposit in Online Banking: Sign in to RBC Online Banking; From Accounts Summary, select the account you’d like to receive direct deposits for; Click Set Up Direct Deposit with Canada Revenue Agency, under the Security and Account Management section on the right of the page; Follow the on-screen instructions.

The manage direct deposit service is currently unavailable in our CRA login services. You can still enrol directly through your financial institution.

Don't miss a payment!

Direct deposit is fast, convenient and secure. Register for direct deposit today to ensure you get your payments on time in the event of an emergency or unforeseen circumstances!

For more information and to find out how to update your account, please visit our Frequently asked questions about direct deposit.

If you receive one of the following payments from the CRA and have a Canadian bank account, you can sign up for direct deposit:

- income tax refund

- goods and services tax/harmonized sales tax credit and any similar provincial and territorial payments

- Canada child benefit and any similar provincial and territorial payments

- Canada workers benefit

- deemed overpayment of tax

Note

If you have already signed up for direct deposit with the CRA, we will use the existing bank account information for any payments you are entitled to receive.

How to sign up

Online

You can sign up yourself if you are registered for My Account. If you are not yet registered, why wait? My Account can help you quickly and easily manage your tax affairs online, including signing up for direct deposit or changing your account information.

You can also see if you have any uncashed cheques that are older than six months.

Online - mobile application

To start or update direct deposit information, use MyCRA.

New Sign up through more financial institutions

You can now sign up for direct deposit or change your account information through many financial institutions.

Banks (individuals)

- Alterna Bank Alterna Savings and Credit Union Limited Alterna Savings

- ATB Financial Alberta Treasury Branches

- BMO Bank of Montreal

- Canadian Western Bank CWB Financial Group

- CIBC Canadian Imperial Bank of Commerce

- HSBCHSBC Bank Canada

- Laurentian Bank Laurentian Bank of Canada LBC

- LBC Digital Laurentian Bank of Canada

- National Bank National Bank of Canada

- RBC Royal Bank of Canada

- Scotiabank Bank of Nova Scotia

- TD Canada Trust Toronto-Dominion Bank TD Bank

Credit unions and trust companies (individuals)

- ABCU Alberta's Credit Union

- Alterna Savings Alterna Savings and Credit Union Limited Alterna Bank

Once you provide consent through one of these financial institutions, your CRA direct deposit information will be updated the following day. We encourage you to visit your financial institution’s website for information on how to sign up.

By phone

To sign up for direct deposit or to change your account information, call CRA at 1-800-959-8281. You will need your:

- social insurance number

- full name and current address, including postal code

- date of birth

- most recent income tax and benefit return and information about the most recent payments you received from the Canada Revenue Agency

- banking information: three-digit financial institution number, five-digit transit number, and your account number

Do not close your old bank account until your first payment has been deposited to your new bank account as it may already be in process.

If you expect to receive at least one of the following payments for your business from the Canada Revenue Agency, you can sign up for direct deposit:

- corporation income tax refund

- goods and services tax/harmonized sales tax refund

- refund of excise tax or other levies

- refund of payroll deductions

- Canada Emergency Wage Subsidy (CEWS)

How to sign up

Online

As a business owner or delegated authority, you can start or update a direct deposit online.

To complete your direct deposit application or to manage your direct deposit information, log in or register for:

New Sign up through financial institutions

The CRA may contact you by phone to confirm information. If you have questions about a call you receive, you may read more about how to recognize scams.

You can now sign up for direct deposit for certain business accounts or change your account information through your financial institution. To be eligible to enroll for CRA direct deposit for businesses, your business must have a valid 15 digit business number and one of the following CRA program accounts:

- RT – Goods and Services Tax/Harmonized Sales Tax

- RP – Payroll

- RC – Corporate Income Tax

- ZA - Canada Emergency Rent Subsidy (CERS)

* Note: You will need to sign up your Canada Emergency Rent Subsidy account (ZA) to receive the CERS by direct deposit.

Banks (businesses)

- BMO Online Banking Bank of Montreal or BMO Online Banking for Business Bank of Montreal

- Canadian Western Bank CWB Financial Group

- CIBC online banking Canadian Imperial Bank of Commerce or CIBC Cash Management Online Canadian Imperial Bank of Commerce

- HSBC HSBC Bank Canada

- Laurentian Bank (coming soon)

- RBC Royal Bank of Canada

- Scotiabank Bank of Nova Scotia

- TD Canada Trust Toronto-Dominion Bank TD Bank

Credit unions and trust companies (businesses)

If you are the trustee, custodian, executor, or other type of legal representative for a trust, you can start or change direct deposit information. The name on the bank account must match the name of the trust.

How to sign up

By mail

- Fill out Form T3-DD, Direct Deposit Request for T3.

- Mail the completed form to the address on the form.

For more information about direct deposit for trusts, call 1-800-959-8281.

You can start direct deposit or change your banking information related to direct deposit if the following conditions apply:

- you are a Canadian payer or agent

- your non-resident tax account has three alpha characters starting with NR followed by six digits

- your Canadian bank account is registered in Canada

- the name on your Canadian bank account matches the name on your non-resident tax account

If you are a non-resident of Canada filing a Form NR7-R, Application for Refund of Part XIII Tax Withheld, you can ask the Canada Revenue Agency to deposit your refund directly into your bank account at a Canadian financial institution. The name on the bank account must match the name of the applicant or the authorized person who signs the certification section on Form NR7-R.

How to sign up

By mail

Non-resident account holder

- Fill out Form NR304, Direct Deposit Request for Non-Resident Account Holders and NR7-R Refund Applicants.

- Mail the completed form to the address on the form.

NR7R refund applicant

Cra Direct Deposit Enrolment Form

- Fill out Form NR304, Direct Deposit Request for Non-Resident Account Holders and NR7-R Refund Applicants.

- Attach the completed NR304 to the Form NR7-R, Application for Refund of Part XIII Tax Withheld refund application.

- Mail the completed forms to the address on the forms.

For more information about direct deposit for non-resident account holders and NR7-R refund applicants, call 1-855-284-5946.

Cra Direct Deposit Tax

Thank you for your help!

Cra My Account Direct Deposit

You will not receive a reply. For enquiries, contact us.

- Date modified: